- Q3 earnings reflect Aramco's ability to generate significant value

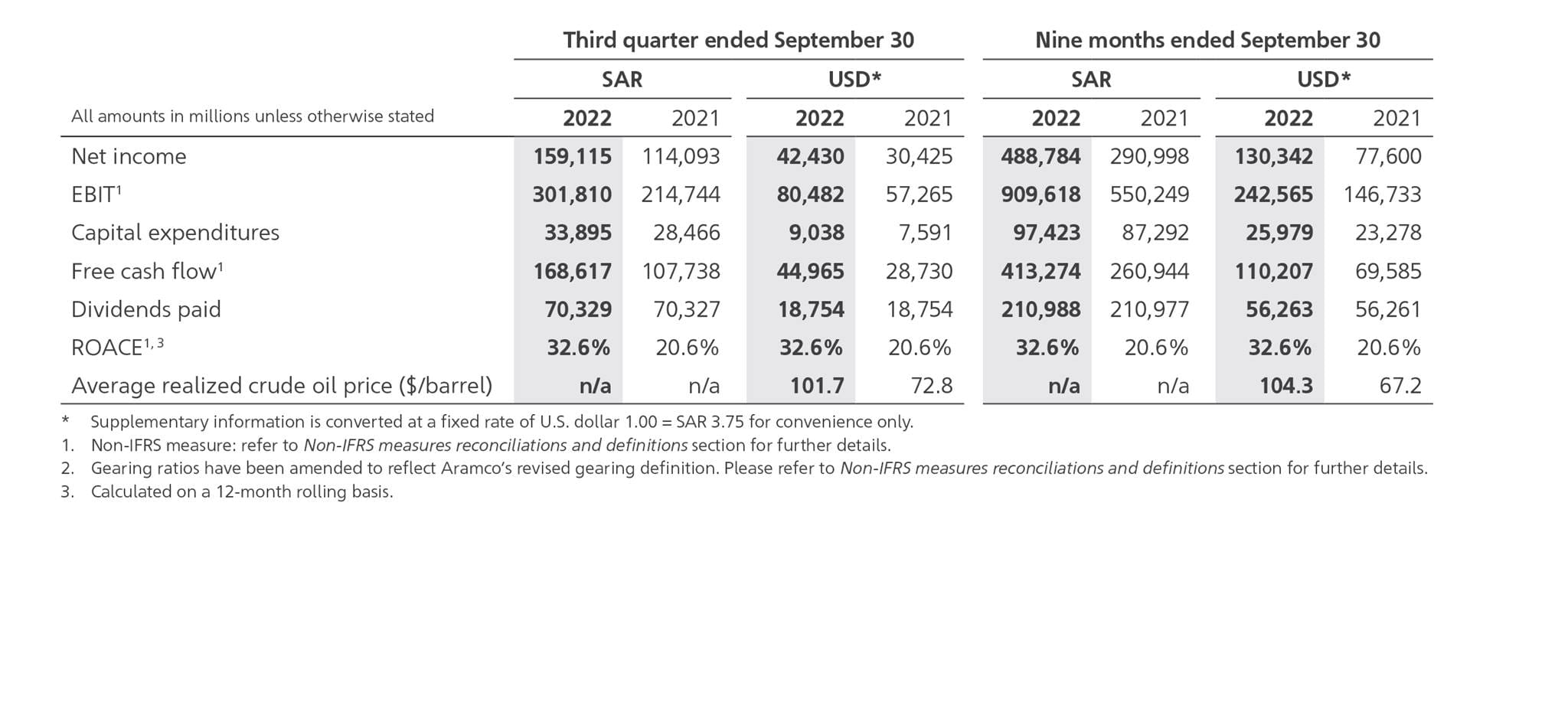

- Net income: $42.4 billion (Q3 2021: $30.4 billion)

- Cash flow from operating activities: $54.0 billion (Q3 2021: $36.3 billion)

- Free cash flow1: $45.0 billion (Q3 2021: $28.7 billion)

- Gearing ratio1, 2: -4.1% as at September 30, 2022, compared to 12.0% at end of 2021

- Q2 dividend of $18.8 billion paid in the third quarter; Q3 dividend of $[18.8] billion to be paid in the fourth quarter

- Partnership with F2 and F3 highlights work on advanced low-carbon transport solutions

- World's first independent certifications of blue ammonia and hydrogen production

Commenting on the results, Aramco President & CEO Amin H. Nasser, said:

“Aramco's strong earnings and record free cash flow in the third quarter reinforce our proven ability to generate significant value through our low cost, low-carbon intensity Upstream production and strategically integrated Upstream and Downstream business. While global crude oil prices during this period were affected by continued economic uncertainty, our long-term view is that oil demand will continue to grow for the rest of the decade given the world's need for more affordable and reliable energy.

“Against the backdrop of global underinvestment in our sector, we are extending our long-term oil and gas production capabilities while also working towards our previously stated ambition to achieve net-zero Scope 1 and Scope 2 greenhouse gas emissions from our wholly-owned operated assets.

“Our plans for our Downstream expansion continue to move forward as we seek to leverage the significant potential of our products to meet rising global demand for petrochemicals, which will be critical to the materials transition that is required to support a lower-carbon future. In addition, we continue to develop new, lower-carbon energy solutions as we work to be part of a more practical, stable and inclusive energy transition.”

For more information, please see the 2022 Saudi Aramco Third Quarter Interim Report.

Key financial results